Last updated: September 28, 2023

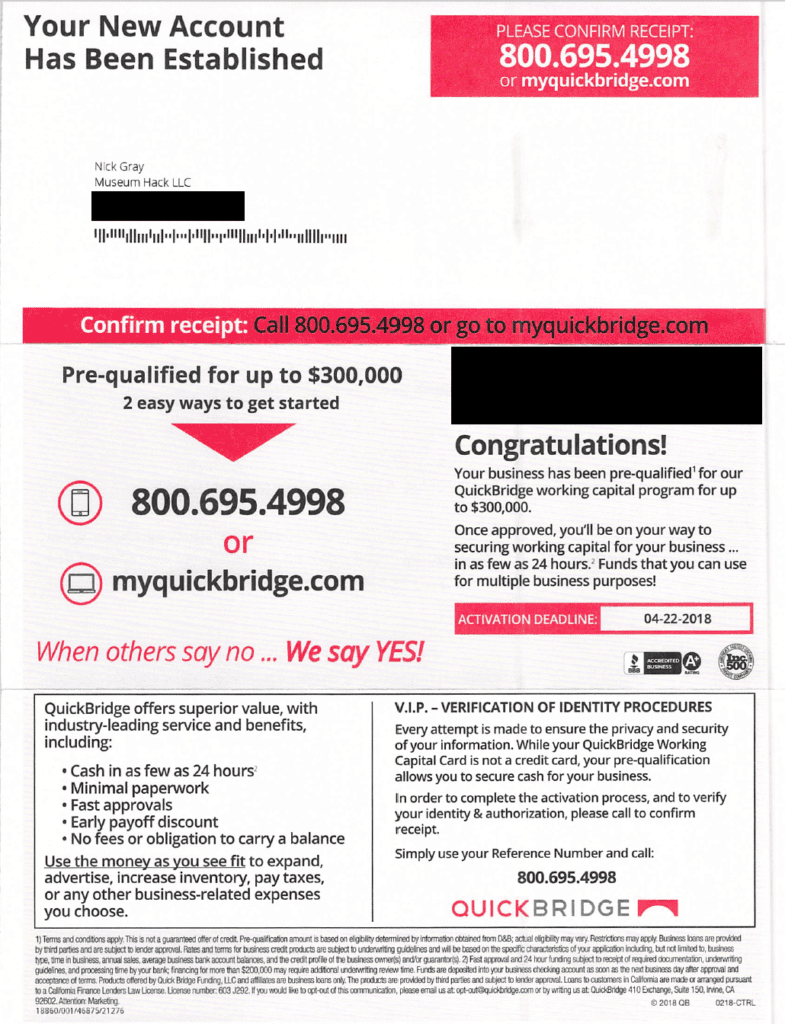

I was surprised to receive a piece of mail today from QuickBridge saying “Your New Account Has Been Established” because I never signed up for this.

It turns out that QuickBridge is offering people a fake-looking credit card for their “working capital” offer of a loan up to $300,000.

In this article, I’ll look at who QuickBridge is, what they’re offering with that credit card, and my analysis.

QuickBridge Funding

QuickBridge specializes in small business loans. That’s totally normal. But I’ll be honest: QuickBridge uses very aggressive marketing tactics, including repeated direct mail with sensational offers, plus cold calls.

That isn’t to say that they’re not legitimate. But the marketing materials they sent me, a small business owner, felt… shady? Deceptive?

They appear to be doing predatory marketing to small business owners. As a small business owner myself, this is worrisome.

QuickBridge Credit Card Offer

Here is a picture of the letter and fake scam credit card they sent me in the mail:

This is very different than the type of business loans that business development companies make. These QuickBridge loans have very high-interest rates.

After some research, it looks like this company was possibly previously called BlackRock Lending Group. BlackRock Lending Group has been named by the State of Washington as “an advance fee loan scam.” However, this is all speculative information.

Letter Wording

Here are some of the phrases they used in my offer letter:

- Pre-qualified for up to $300,000

- 2 easy ways to get started

- Congratulations! Your business has been pre-qualified for our QuickBridge working capital

- When others say no … We say YES!

- QuickBridge offers superior value with industry-leading service and benefits, including

- Cash in as few as 24 hours

- Minimal paperwork, Fast approvals, Early payoff discount

More Mailer Images

I’ve taken photos and scanned in the exact mailers that QuickBridge sent to my old business, Museum Hack, here:

More Information on QuickBridge

I need to update these links more for 2023, but for now, here’s what I have for more information:

- They have an “Excellent” TrustPilot score

- Quick Bridge Funding possibly did business as BlackRock Lending Group which is has been named by the State of Washington as “an advance fee loan scam.”

- NJ Bankruptcy Case Takes Aim at Small Business Financing — Merchant Cash Advances and Bank Partnerships: “The complaint attacks the QuickBridge program as a “rent a charter” arrangement meant to circumvent state usury laws and regulations.”

- Class Action suit against Bank of Internet which involves QuickBridge

- I’m not going to link to their homepage, but it is located at (TheirCompanyName.com)

- Watch Out for This Unsolicited Credit Card includes video

- Connector Capital Scam Credit Card

Comments and More Information

Do you have information about this company? If so, leave a comment below (Facebook required) and it will post here for others to see.

2023 update: A few people have made great comments along the lines of,

Just because something is a high-interest loan does not make it a scam.

And I agree with that! There are plenty of businesses who are legitimate and offer high-interest loans which can be extremely helpful in a cash-crunch situation. What I take offense with is QuickBridge’s aggressive marketing, use of fake credit cards, etc.