Last updated: October 2, 2023

Business development companies, also known as BDCs, make multi-million dollar risky loans to middle-market companies.

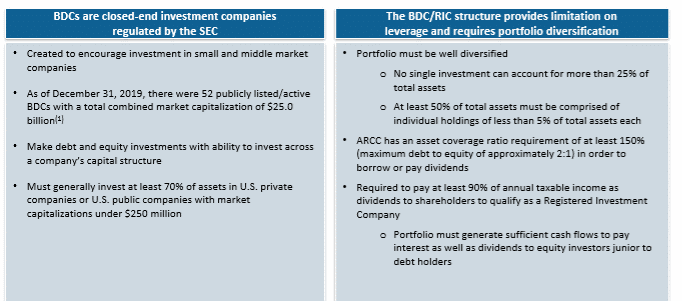

Today there are ~50 publicly-traded BDCs on the Nasdaq and NYSE. Two of the biggest are $ARCC and $GBDC.

BDCs are valued based on their portfolio of these so-called “risky loans,” or non-investment grade debt.

There are 50 to 150 loans inside each BDC. The interest rates for these loans are typically 5-15%. I think that over 90% of the loans are senior or first lien.

Hot gossip: Our old family business, Flight Display Systems, is now controlled by Fidus Investment Corp ($FDUS), a BDC.

I first heard about Business Development Companies, or BDCs, in David Einhorn’s 2010 book Fooling Some of the People All of the Time.

There was a lot of scandal in that book. It spoke about poorly valued loans and many problems with the SEC. People have told me that the world of BDCs in the late 2000s was more of a “Wild West” and mom-and-pop attitude.

BDCs seem like an interesting area to learn more about investing. I’ll post my research notes here on this page.

What is a BDC?

“Business development companies provide businesses with capital, and in turn, give people access to investments that were once exclusive to the wealthy….” via Saratoga Investment Corp: About BDCs

Definition, a business development company (BDC) is:

- “a type of closed-end fund that makes investments in developing firms.”

- “a closed-end fund that provides small, growing companies with access to capital.”

- “an organization that invests in small- and medium-sized companies as well as distressed companies.”

via Investopedia: MUTUAL FUND ESSENTIALS – Business Development Company (BDC)

How Do BDCs Work?

They’re sort of like REITs, but for smaller companies instead of real estate.

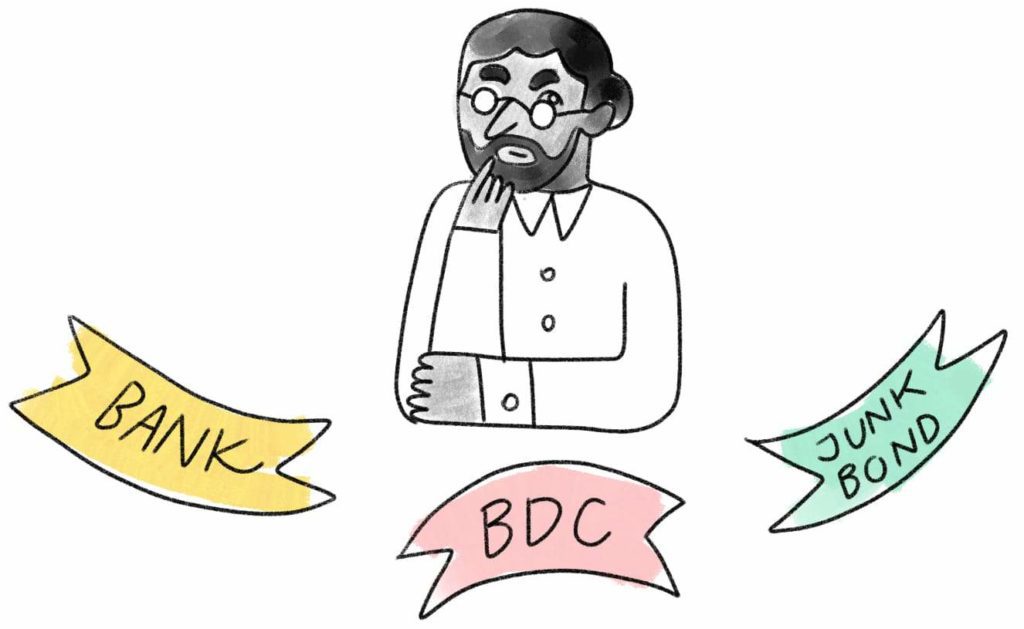

Imagine you run a company and you need a big loan of $10 million dollars. To get a loan of this size without giving up any equity or ownership in your company, you only have a few options:

- Ask your bank. This will be the lowest interest rate. But your bank will probably say No, unless you are using the money to buy something that is very secure (like an office building, property, or large equipment).

- Issue a junk bond. This takes a lot of time, is highly regulated, and often comes with many restrictions.

- Get a loan from a BDC.

Private Equity and BDCs

BDCs are chosen by many business owners for multi-million dollar business loans, but these days they are especially chosen by private equity companies. In the loan origination stage, private equity firms can team up with BDCs to get money (loans) to purchase companies. BDCs help private equity to finance their investments and avoid dealing with banks which might not make the loans.

Previously I wrote about:

- Is a Correction Near? My Current Stock Market Investing Thesis

- What I Learned About Inflation at London’s Bank of England Museum

BDC Stock Tickers and Specific Companies

I’ve learned that BDCs can be categorized into three types: Large, Medium, and Small.

Large BDCs

The first two BDCs I heard about and looked up were:

- $ARCC – Ares Management

- $GDBC – Golub Capital BDC

Medium BDCs

- $FDUS – Fidus Investment Corporation

- $WHF – WhiteHorse Finance

Small BDCs

- $HCAP – Harvest Capital

- $GEC – Great Elm Capital (downgraded!)

- $CMFN – CM Finance Inc

See here for a larger list of publicly traded BDCs from Closed-End Fund Advisors.

Best Resources

These are the best resources I’ve found for researching more about BDCs:

- BDC Reporter and BDC Credit Reporter from Nicholas Marshi

- Business Development Company Universe, a very large list of publicly-traded BDCs from Closed-End Fund Advisors (CEFA).

- PDF: The ABC of BDCs and Closed-End Funds, from the Active Investment Company Alliance.

- Investopedia’s page about BDCs, with helpful definitions.

- BDC Buzz on Seeking Alpha (paid)

- Active Investment Co. Alliance is a 501(c)(6) non-profit trade association for listed closed-end funds and business development companies.

Questions I Have About BDCs

Note: I have a lot of questions! As I’ve continued to research BDCs, I keep getting more confused (this is due to my general lack of knowledge about financial matters). I’ve created a Google Doc here to list my open questions. Please feel free to edit it and add some answers or your own questions.

Other Information

Recent News Articles on BDCs

- 2020-05-21 Refinitiv LPC: 1Q20 BDC Earnings Review

- 2020-05-18 Bloomberg: For Private Debt’s BDCs, the Worst May Be Yet to Come This Year

- 2020-04-16 Reuters: Dividend cuts loom over BDC market as pandemic extends

- 2020-04-13 Bloomberg: These Firms Borrowed to Lend to Indebted Companies. It’s Going Badly

- 2019-06-11 Bloomberg: Why Private Equity’s Biggest Names Are Getting Into a Small-Loan Backwater

I’ll also keep an eye on BDC Reporter and their Twitter account @bdcreporter, run by Nicholas Marshi and his team at BDC Investment Advisers.

Research on BDCs

Several companies provide proprietary data on business development companies and/or middle market loans. Here are a few that people have referred me to:

- S&P Global: Leveraged Commentary and Data (offers a free trial)

- AdvantageData: Business Development Companies (BDC)

- I made my own List of Investor Relations Firms in NYC and Chicago because I was curious which IR firms some BDCs were using

BDC People on Twitter

- @itskelseybutler Kelsey Butler

- @David_BrookeDL David Brooke

- @bdcreporter

- BDC Buzz on Seeking Alpha is a great resource

Conclusion

To be continued! I’m still exploring and researching.

Do you know a lot about BDCs, or have some information or links I can add to this page? Send me an email or give me a call.– Nick

BONUS — On April 14, 2020, Howard Marks called it a “regulatory wonderland” with the Fed telling BDCs that they can value their loans at December 31st prices: (source)

(The Fed) gave regulatory relief to business developments companies, or BDCs, which buy or make loans to mid-size businesses. In order to help them avoid tripping limits on their activities, the Fed said they can value the loans on their books at December 31 prices. “The SEC is primarily trying to address the issue that a temporary markdown in the fair value of BDC portfolio companies could increase leverage above the regulatory maximum, thus limiting further lending by a BDC. As such, the SEC is allowing BDCs to use an adjusted portfolio value when calculating their asset coverage (leverage) ratio.” (Keefe, Bruyette & Woods on April 9th) In other words, we’re in a regulatory wonderland where there’s no pretense that financial statements have to be accurate or current.

LAST UPDATED

2020-05-08 page created, outline, initial companies

2020-05-21 added Bloomberg link, ToC, Twitter links, lots of news links

2020-05-21 removed reference to REITs, thanks to Josh Clarkson!

2020-05-22 I started this list of questions I have about BDCs. Added link to Refinitiv LPC video.

2020-05-24 Added link to Lincoln International’s 1Q20 key takeaways report, thanks @Lazarbeam9

2020-05-24 Added links to research, removed links to Glassdoor reviews, linked to Saratoga’s page on BDCs

2020-06-10 I previously posted this list of questions I have about BDCs. Someone was kind enough to answer them recently!

2020-06-11 Oh gosh, I really need to update this! I included a link here in my latest issue of my Friends Newsletter. I have collected tons of new notes in a dozen Google Docs. Quickly updated the introduction with more definitions. Tried to give a high-level overview. More to come.

2020-06-19 Added cartoons and illustration by Fru Pinter.

2020-07-07 updated images with color from Fru.

2020-07-21 added a link to my List of Investor Relations Firms in NYC and Chicago