Last updated: August 18, 2020

Warren Buffett says his first two rules of investing are:

- Don’t lose money.

- See rule number one.

I have been thinking about asset allocation and investing a lot lately.

In what could be a terrible decision, I’ve decided to share my learnings here on my blog. I hope someone smarter than me will correct me where I’m wrong and help point me in the right direction towards better learnings.

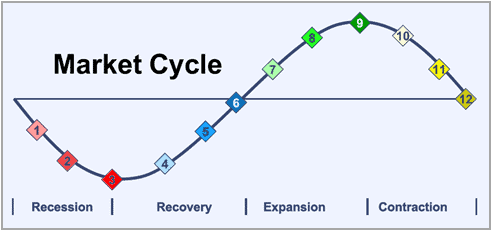

Market Cycles

I’ve read a lot recently about how the stock market works in cycles.

There are cycles of growth (a bull market), and cycles of recession (a bear market).

Ray Dalio of Bridgewater, analysts at Bessemer Trust, and commentaries in the Wall Street Journal have said that American equities are currently in the “late cycle” of a long-running bull market.

Based on my interpretation of their commentaries, these people believe our current bull market may be coming to an end.

Perhaps in the next few months, or maybe in 2020.

Nobody knows when, but many smart people I’ve spoken to believe that a correction will happen.

Disclaimer: I’m Long on America

Disclaimer: I am a long-term believer in the American economy. I love America, the dollar, entrepreneurship, capitalism, etc. So I will continue to hold a significant amount of equities in the “buy and hold forever” mentality. Especially my AMZN, GOOG, and FB.

If We Are “Late Cycle,” So What?

My portfolio has done amazingly well over the past 10 years.

If there is a recession which affects S&P 500 indexes, a significant percentage of my net worth would get wiped out.

Between now and the time it would take for the market to recover, I might want access to my capital.

I might want a lump sum of money to buy another business, a home, start a family, or party my face off in Ibiza.

Just kidding on the last one. If I was blowing money, I’d probably fly all of my friends to our island on a private jet.

Now I wonder if I’m over-exposed to the equity markets in a way that would hurt me if we enter a recession.

I guess it would only hurt me if I want access to the capital before an anticipated recovery from the recession.

Or if I wanted to try to sell high and buy low, which people like Bogle and Buffett recommend against (“Don’t try to time the market.”).

Things Unknown: How Treasuries Work

Recently I have heard phrases like “Federal monetary policy” and the “yield curve” discussed.

I do not know about these things. I want to learn.

My limited understanding is that if the government is raising interest rates, it would mean that there will be less easy money available to be invested into the economy. This would cause a reduction in investments and a curb to economic growth.

Some smart people like the Bessemer analysts and Ray Dalio frequently mention Treasuries and this “yield curve” as a possible indicator of a coming end to the bull market.

What we do not know is when the bull market will end. Or what will happen after it ends.

What Could Happen When The Bull Market Ends

- Will corporate growth become flat?

- Will we enter a period of recession?

- Will the S&P 500 correct and fall, as we saw in early February 2018?

- Will things keep improving, and the bull market continue?

- Will Trump come up with something new, like the tax overhaul, to inject more money into the economy?

- Will we win the “trade war” with China?

I do not know the answers to any of these, and I know that probably nobody does. The market is too complicated and dynamic for anyone to predict what will happen.

My Hunch: I Should Rebalance My Portfolio

I have a hunch that I should re-balance my portfolio to reduce my risk and exposure to the American stock market.

My portfolio is not very diversified right now.

In fact, my portfolio would cause terror in most financial planners: I have about 95% of my total assets in equities like S&P 500 indexes and tech stocks.

Based on advice from Ray Dalio’s “All Weather” portfolio thesis, I think that I should dollar cost average some of my winnings from the past few years and begin to sell down my S&P 500 equities to buy up bonds.

Plus a little bit of gold and other commodities.

Whenever I say that I’m buying gold, it makes me feel like a real Old Person who hates technology. BTW: if and when I buy more gold, it’ll be in a gold-backed ETF like GLD or IAU. I am not buying actual gold coins.

I should rebalance especially the portion of my portfolio which holds market indexes that I have less understanding or long-term faith in. As compared to my tech stocks, which I have some casual knowledge of business conditions.

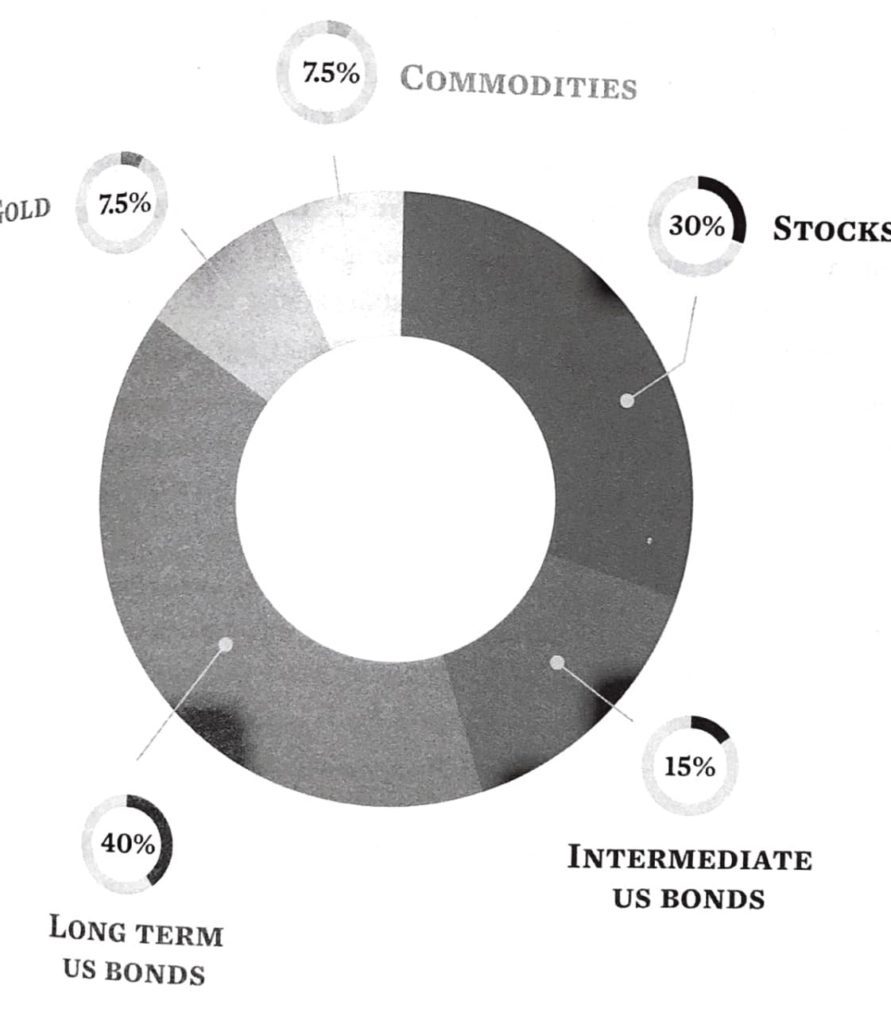

Ray Dalio’s “All Weather” or “All Seasons” Portfolio

I like the idea of this portfolio as a way to minimize risk during times of uncertainty:

- 30% – Vanguard Total Stock Market ETF (VTI)

- 40% – iShares 20+ Year Treasury ETF (TLT)

- 15% – iShares 7-10 Year Treasury ETF (IEF)

- 7.50% – SPDR Gold Shares ETF (GLD)

- 7.50% – PowerShares DB Commodity Index Tracking Fund (DBC)

Tech Stocks

I hold a significant amount of GOOG, AMZN, and a little FB. So you can see how and why I have been especially lucky during the past five years.

I continue to believe in the long-term potential of these companies. I think that Google, Amazon, and Facebook will continue to innovate. They can ride a general trend of “the internet eating everything,” eroding profits from other staid industries.

The recent European GDPR enactment will be good for Google’s ad revenue, Amazon continues to grow into new markets (but is AWS facing increased competition?), and Facebook’s Instagram is a market-leader that continues to consume attention (including my own) and thus drive ad revenue.

Summary and Rebalancing Thoughts

The main rule of investing is: Don’t lose money.

Everyone also says “Don’t try to time the market.”

But I believe there is an increased risk to lose money in my portfolio. It is extremely overweight in American index equities that have performed exceedingly well but also seem over-valued.

The re-balanced mix that I am considering would:

- reduce my overall American stock market exposure,

- continue owning my existing tech holdings, and

- purchase bonds in the form of US Treasuries, plus some commodities.

Finally, in the event of a recession and if I kept all of my current allocations, I would only “lose” money if I needed to sell my stocks to have access to my capital. This is why people say not to try to time the markets: If you don’t need the money, and you believe in the American economy in the long-run, just keep it in the market.

Next Steps

I want to learn more about Treasuries (bonds?) before I blindly follow the advice I have heard to invest in 10-year and 20-year treasuries as a way to offset risk.

Concerns

It is scary to think about buying treasuries and commodities because these are something that I do not know about, have never purchased before, and am making a “guess” into the future. I’ve never done that before. This is cause for concern.

Because of all of these variables, I believe it will be smart that if and when I do make a move, I should dollar cost average my rebalancing and not try to do it all at once.

To be continued.

Do you have any suggestions?

Or questions or comments?

All advice is appreciated. Please let me know in the comments on this post, or email me directly.

More Reading, Additional Resources

- Duplicating The All-Weather Fund Using Low-Cost ETFs: This is what I’m basing my portfolio design off of.

- Financial Samurai Mid-Year 2018 Investment Review And Outlook: My friend Scott forwarded me an issue of this guy’s blog. I like his thoughts and am curious about his asset allocation.

- Why The ‘All-Weather’ Portfolio Has Stumbled (March 2018): I need to understand the risks associated with this portfolio if I want to mimic it.

- Buffett Indicator: Where Are We with Market Valuations?: I saw this linked somewhere. Right now it says “The Stock Market is Significantly Overvalued”

- World’s Biggest Hedge Fund: “We Are Bearish On Almost All Financial Assets”: Bridgewater saying, “2019 is setting up to be a dangerous year, as the fiscal stimulus rolls off while the impact of the Fed’s tightening will be peaking.”

- Why a Treasuries Bear Market May Not Live Up to the Hype: Will read as part of my research on Treasuries.

- Top 5 Gold ETFs for 2018: I bought IAU, because that’s one that Bridgewater owns.

You might also like:

- So you’ve got a million dollars. Now what?

- If I Had $10 Million Dollars, How Would I Live Differently?

- What you can learn about inflation at London’s Bank of England Museum?

Comments

- Tim ONeill: Rule 4 As interest rates increase, bond values fall. We expect two more increases this year and maybe two or three next year, do the research and understand the relationship between your investment options. The Fed has kept rates artificially low as we have clawed our way out of the 08 economic recession, timing the market is always a bad idea, but timing the bond market is always the right plan. If your investment time horizon is long you have less risk, if instead you have short term plans be wary. Your desire for professional help and added research is the best part of your blog.

- Chris Corliss: The problem with your plan is that it is too low risk for someone your age. You are trying to time the market, which is universally considered to be extremely difficult. Not sure if you are in a taxable account, but if so, a swich like this will create large taxable gains. Before enacting a plan like this, you need to ask some questions: When will I get back in? 5% decline? 10%? 20%? What if the market continues to go up?A couple other places to look for diversity: VXUS (add only internation exposure), VNQ (real estate) and VTC (corporate bonds).

- Justin Johnson: Engaging as always. I plan to keep my 2 stocks and not sell until I retire.

- Geoffrey Hamilton: Get out, put it all in Bitcoin. Even if the S&P goes up another 10%, which it won’t, it’s still going back to 1600 eventually. Bitcoin is going to 50k this year.