Last updated: October 11, 2023

The Bank of England Museum is a money and policy museum located in the City of London.

Everyone should check this place out! I went and I got to hold a super heavy solid gold bar. Here’s what I learned.

What does the Bank of England do?

The Bank of England maintains monetary and financial stability to promote the good of the people of the United Kingdom.

They also monitor inflation.

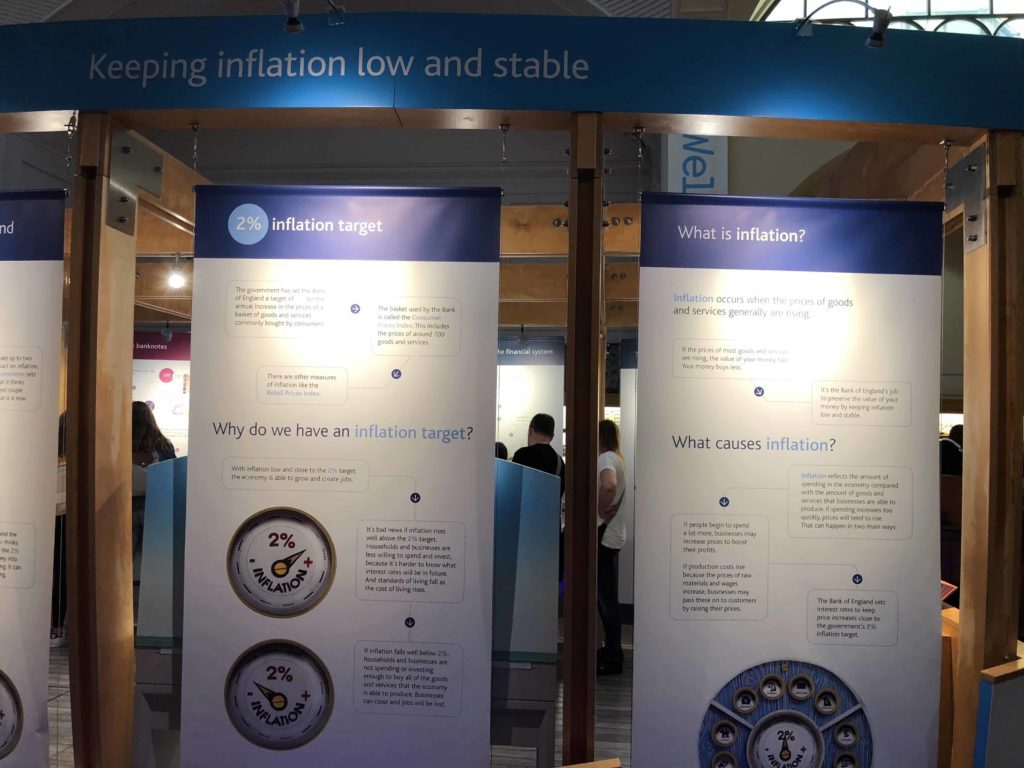

Ideally the Bank of London wants inflation to be 2% per year. That’s the target rate assigned by the Government.

- Inflation is primarily measured using a basket of ~700 goods and services commonly bought by consumers called the Consumer Prices Index.

- Inflation occurs when the prices of goods and services generally are rising. The value of your money falls, and your money buys less.

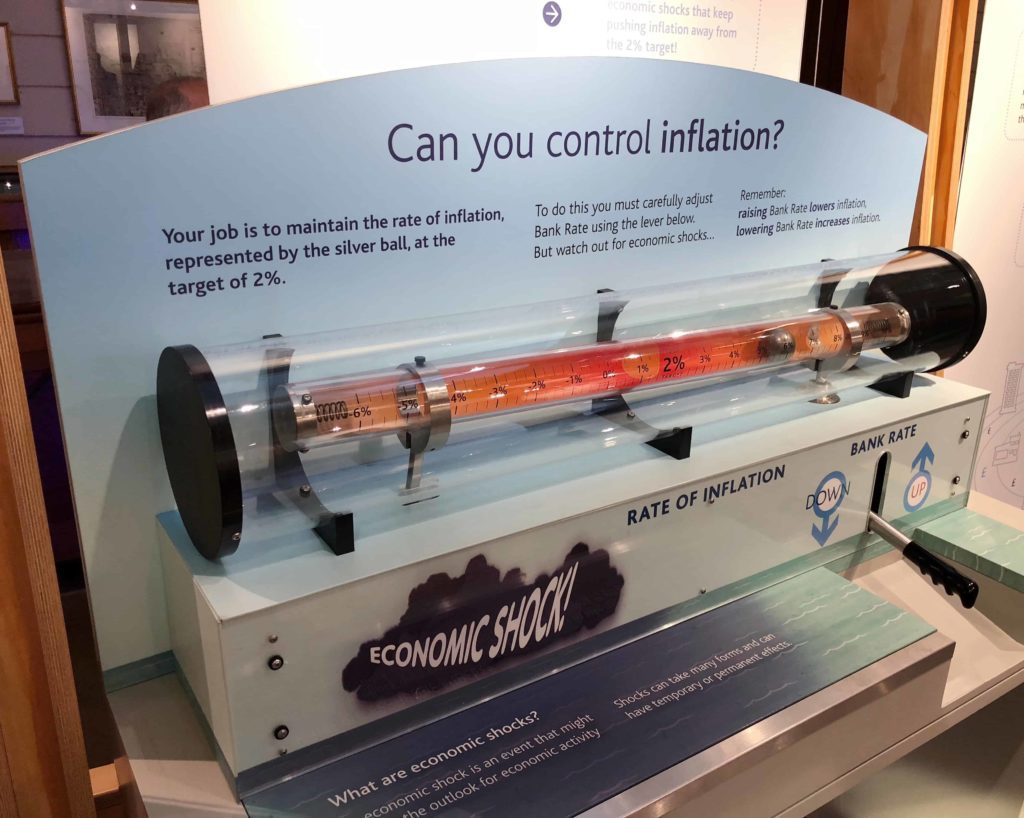

Kids Game About Inflation

More Inflation Facts From The Bank of England Museum

At the 2% inflation level, they say the economy is able to grow and create jobs.

Remember: raising Bank Rate lowers inflation, lowering Bank Rate increases inflation.

Raising and Lowering the Bank Rate

If inflation looks like it will go above 2%, then the Monetary Policy Committee will probably increase interest rates.

After they raise the interest rates, people tend to spend less and save more. That puts downward pressure on inflation.

- If inflation is going to be below 2%, then the Committee will probably cut interest rates.

- Lowering interest rates tends to increase spending and inflation.

Low and stable inflation is crucial to a thriving and prosperous economy

Here’s what the museum says about that:

Q: Why is low and stable inflation good?

A: Unstable rates of inflation are costly to households and companies. They make it hard to see how prices of individual goods are changing compared with one another. And uncertainty over future prices makes it more difficult to enter into long-term contracts. Historically, high inflation has tended to be more unstable.

Fun fact: Changes in Bank Rate can take up to two years to have their full impact on inflation.

Another Kids Game

What causes inflation?

If spending increases too quickly, prices tend to rise. This happens in two main ways:

-

- With more spending, businesses increase prices to boost or maintain their profits.

-

- If production costs rise because the prices of raw materials and wages increase, businesses may pass these on to customers by raising their prices.

Quantitative Easing

Quantitative Easing is when you inject fake money directly into the economy in order to boost spending. This helps to avoid deflation or maybe a recession.

What is the fake money used for?

“The Bank of England creates new money electronically to buy financial assets like government bonds from insurance companies and pension funds. This cash injection encourages businesses to invest and consumers to spend. Increased spending helps get inflation back on track to meet the government’s 2% target.”

Fun fact: Quantitative easing was first used by the Bank of England in March 2009, when interest rates were cut to 0.5%.

Video link: How Quantitative Easing Works, a short film from the Bank of England as linked on the museum exhibit using a QR code.

Bonus Content: Gold

I enjoyed the 10 minute video about gold and the gold deposits that are underneath the museum. Also the story of the honest Englander who found a secret way into the vaults in the 1820s and told the Bank Directors instead of stealing all the gold!

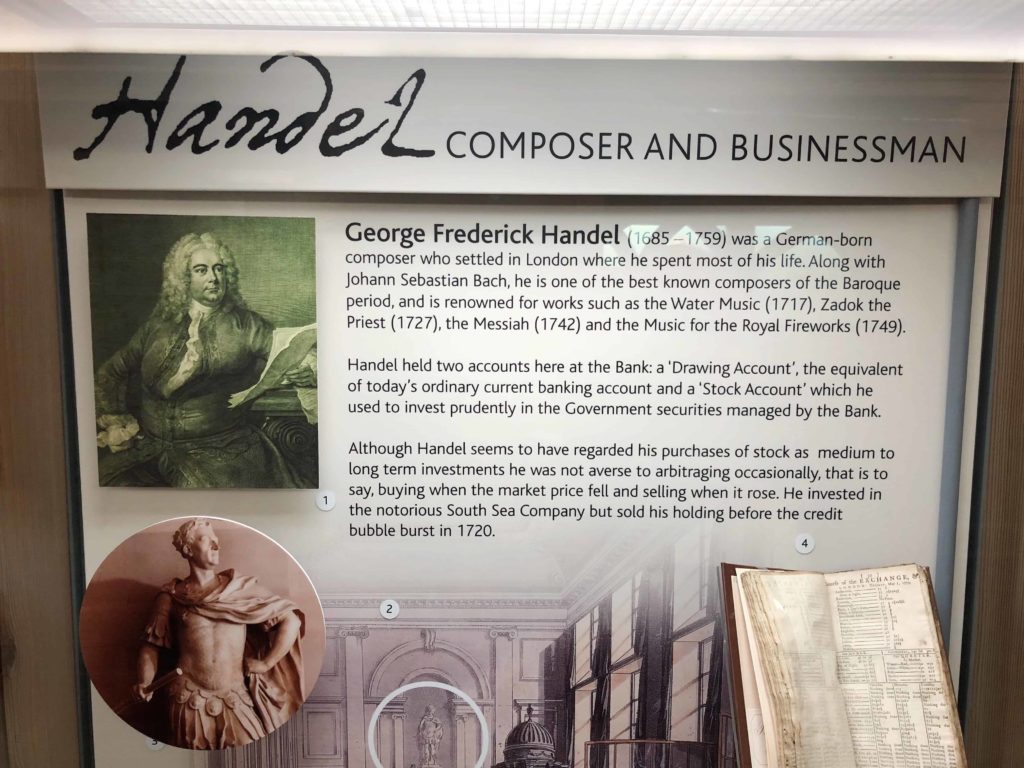

Bonus: Handel Was A Baller

Classical composer AND excellent market-timer. He got in and got out of the South Sea Company before it crashed.

Conclusion

I liked nerding out at this museum to learn about fiscal policy. I’m trying to learn more about money and finances. Getting a chance to touch and hold a real gold bar felt special. (So special, in fact, that I did it twice!) You should go to this museum if you have an interest in finance or money.

For Families and Children

Many families were playing some sort of scavenger hunt game that they seemed to be having fun with. You can get the free scavenger hunt from the Information Desk at check-in.

If you liked this article, you may be interested to read my stock market investing thesis from 2018.