Last updated: February 9, 2024

Black-and-White Capital is an activist hedge fund created in 2016 owned and operated by Seth Wunder.

The more I look into Seth Wunder and Black-and-White Capital, the more I find myself returning to one simple question:

Who is Seth Wunder?

I am genuinely curious to learn more about Seth and his company, especially after they were the first to take an activist investor stance on Etsy in early 2017.

Here’s what I know so far.

News on Seth Wunder

Here’s some recent news:

Seth and Black-and-white Capital’s 2020 Investments

- black-and-white Capital LP – 13F Holdings

- 2020-06-15 Cloudflare: Seth Wunder is bullish on Cloudfare ($NET). Black-and-white Capital made a $31.3 million investment in Cloudflare in the second quarter.

Nick’s note: To be continued! I’ll try to add more stuff here soon. Please email me if you have current links to add.

2017 Activism: Seth Wunder’s Letters to the Etsy Board

This isn’t recent news, per se, but I love these letters. They are informative and very well-written. As someone who is curious about activist investing and investor relations firms, they have been fun to read.

Interview: August 2017

I found a video footage of Seth being interviewed on the Brummer & Partners website.

History of Black-and-White Capital

black-and-white Capital LP (“black-and-white”) was formed in July 2016 according to this SEC filing. The principal owners of black-and-white are B&P Advisors Inc. and Seth Wunder. The fund will have a focus on global technology, media and telecommunications companies (called “TMT”). The minimum initial investment is $1,000,000.

Original SEC Info for Black & White Capital

If you want to learn more about a subject, you have to follow the money. Below is a fascinating SEC filing concerning Black-and-White’s corporate practices.

Business Insider 2016 Story on Launch

BI covered in July 2016 the cut that Seth was launching Black and White Capital. A great article that chronicles not only the beginning of a fascinating company, but also the start of what our deep dive is leading up to.

Current Employees at Black-and-White Capital LP

As of June 2020, Black-and-white Capital is divided into two teams: Operations and Research.

The Operations team includes:

- Seth Wunder, Principal and Portfolio Manager

- Matthew Berg, Sector Head

- Kevin Foll, Sector Head

- Garrett Marks, Sector Head

- Pierre Mouillon, Sector Head

- Willem van den Bosch, Data & Risk Analyst

The Research team includes:

- Steve Tarrab, CFO & Chief Compliance Officer

- Beau Sullivan, Director of Operations

- Rachel Brewster, Director of Marketing and Investor Relations

Previous team:

- Onnig Terzian, who was included in the list of employees in your original post, left black-and-white Capital in 2019 to serve as portfolio manager for Balyasny Asset Management L.P.

Other Linked Funds

Things like Black-and-White Innovation Fund (Cayman Islands), Black-and-White Innovation Fund LP (Delaware), and Black-and-White Innovation Master Fund Ltd are listed in the SEC filing. More stuff about Brummer & Partners AB that I don’t understand the relationship of, but I’m guessing they put in a lot of money.

bandwcap.com

This is their domain name, where “bandwcap” is short for “Black-and-White Capital.”

The website is just a blank page, so I won’t link to it. Update: there’s a full home page now, as of June 2020!

The black-and-white Capital LP website includes links to:

- About: with their investment thesis, etc.

- Team: with Seth Wunder, Matthew Berg, etc.

- Contact: their office in LA, etc.

Philanthropy

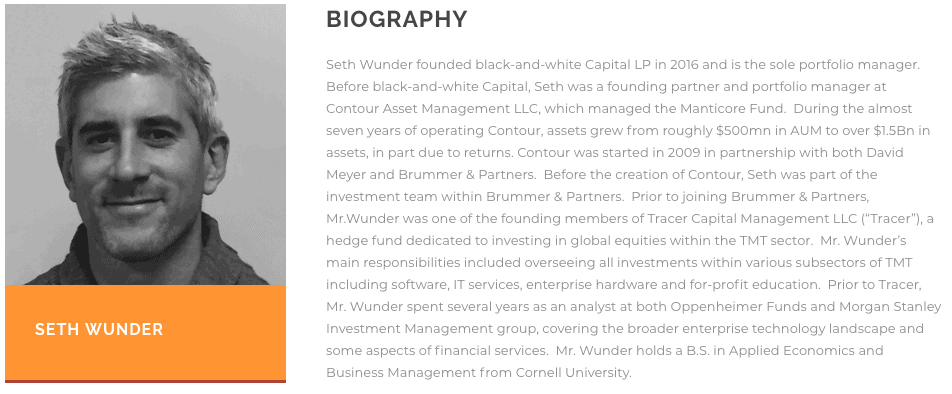

I plan to update this section, but for now, here’s an original bio I had found about Wunder on a charity event and also his Sohn info from 2018:

Excellence in Investing for Children’s Causes Foundation

- “Seth Wunder founded black-and-white Capital LP in 2016 and is the sole portfolio manager. Before black-and-white Capital, Seth was a founding partner and portfolio manager at Contour Asset Management LLC, which managed the Manticore Fund…”

More Information and Links

- Seth Wunder’s LinkedIn profile

- Twitter search for “Seth Wunder”

- Hedge Fund Alert PDF: Wunder arrived in 2009. He previously was a founding member at Tracer Capital.

- 2003: Fortune Magazine Are Chips About To Dip? Probably. Semi stocks have gotten a bit too zesty lately. “Investors got caught up in the momentum of the market, and the move up was strong,” says Seth Wunder, an analyst at OppenheimerFunds. “But we’ve grown more cautious at these levels.”

- 2004: WSJ Top Hedge Funds Take Hit on Tech Downturn Founders David Meyer and Seth Wunder, who were sanguine that the pullback may have helped in “removing the froth and some of the excessive optimism,” added they are not yet betting on a long-term sector-wide decline. “Calling a price bubble is not an easy feat,” they wrote.

- Some interesting hedge fund Twitter talk about Wunder investing in Fortinet (tech security products, TiVo Corp (licenses intellectual property rights), and Groupon

- Washington Post article about another investor that lists Brummer and Partners/Contour Asset Management – David Meyer, Seth Wunder as being ranked 5th in return amongst mid-size hedge funds and at 23% YTD and $728 million in assets.

- News from alumni association of the Beta Theta Chapter of Pi Kappa Alpha Fraternity at Cornell

Lending Club

In October 2017, Seth Wunder was quoted in this CNBC article as being a fan of the Lending Club stock.

Have you been able to find any other stocks he’s a fan of that have succeeded? I’d love to hear about it!

Read about Seth’s take on LendingClub below:

“LendingClub has the potential to be a high growth company taking advantage of technology and scale to produce high incremental margins,” Wunder said. “Comparisons to specialty lenders are misplaced since LendingClub has limited absorption of credit risk.”

Wunder noted that investors providing loans through the online lending platform bear the credit risk, rather than LendingClub itself. But even then, LendingClub has access to a broader range of consumer data than just FICO scores, allowing it to better assess credit risk than a traditional lender, he said, citing a case study with a regional bank.

New loans, or originations, through LendingClub increased 3.6 percent, to nearly $8.7 billion in 2016, despite a scandal that resulted in the CEO’s resignation. Wunder said he expects originations to more than double to $20 billion in about five years.

With those growth prospects, Wunder expects the stock to climb 160 percent to $17 a share from Thursday’s price around $6.50 a share.

2017 Hedge Fund Rising Stars

Wunder was named to Institutional Investor’s list of 2017 Hedge Fund Rising Stars:

Technology is the big disrupter. Seth Wunder plans to profit from such changes by identifying technology winners and losers across all sectors. A former portfolio manager with Contour Asset Management, a long-short equity fund focused on technology, media, and telecommunications, Wunder moved to LA and launched Black-and-White Capital in June 2016. Wunder, 39, who graduated from Cornell University with a BS in applied economics and business management, got his start as an analyst with Morgan Stanley.

Conclusion

I like that Seth Wunder and his firm invests in technology and companies that I like.

I first heard about his work with Etsy, and now I’m impressed with his 2020 position on Cloudflare. I wonder what will happen there.

Wunder’s company seems to be growing, too.

Do you have any information about Seth Wunder or Black-and-White Capital? Email me here and say Hi. He sounds like a smart guy and I’d like to meet him.

RELATED POSTS: Who is John Fichthorn, Hedge Fund Investor? and also my exhaustive List of Investor Relations Firms in NYC and Chicago

PAGE UPDATES:

- 2018-01-17 — first published

- 2018-00-00 — Will McC emailed me some more links and news, which I added into the document.

- 2020-06-18 — basic updates, 2020 info added, links to team LinkedIn profiles