Last updated: October 2, 2023

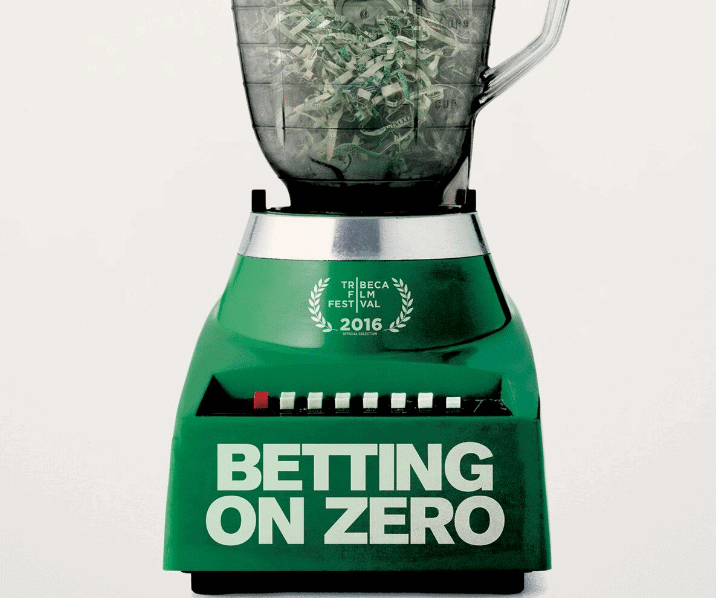

I first heard about John Fichthorn when I was looking for information on the documentary Betting on Zero about Bill Ackman and Herbalife.

Watch the trailer here – it is a great movie.

John Fichthorn helped produce that movie. Today he runs a hedge fund inside of B. Riley Capital Management.

RELATED: You might also like my post about Seth Wunder and Black-and-White Capital.

Career Timeline of John Fichthorn

- 2003: Fichthorn starts serving as co-founder and CEO of Dialectic Capital Management. (source)

- 2009: Fichthorn serves as Director of California Micro Devices Corp. (source)

- 2014: Burke Koonce and Fichthorn create Biltmore Films. (source)

- 2016: Betting on Zero premieres at Tribeca Film Festival. (source)

- 2017: Fichthorn sells or merges Dialectic and starts working as Head of Alternative Investments for B. Riley Capital Management. (source)

- 2017: Fichthorn becomes Director of Health Insurance Innovations, Inc. (source)

- 2018: TheMaven, Inc. appoints Fichthorn as Chairman after making him Independent Director in September of the same year. (source)

- 2019: Fichthorn joins Quantum’s Board of Directors. (source)

Dialectic Capital Management

Fichthorn was co-founder and CEO of Dialectic Capital Management, LLC from 2003 to 2017.

Dialectic Capital Management is a long/short equity hedge fund founded by Luke and John Fichthorn in 2003. John Fichthorn was the Managing Director of technology group at Lee Ainslie’s Maverick Capital before launching Dialectic Capital. John Fichthorn has a B.A. in Astronomy from the University of North Carolina at Chapel Hill. Luke Fichthorn was a VP of equity research at Lazard before founding Dialectic Capital. (source)

Fichthorn was frequently a guest on CNBC’s Halftime Report during his time at Dialectic. You can check out a few of his appearances here:

- August 13, 2014 – Tesla’s ‘demand constrained market’ doesn’t make sense: Fichthorn

- April 27, 2017 – Fichthorn: Ford has $250B of auto loans on the books

- July 27, 2017 – Oaktree’s warning is everything I believe in: Dialectic Capital’s John Fichthorn.

The Betting on Zero Movie

In 2014, John Fichthorn financed the movie Betting on Zero by creating Biltmore Films with co-founder Burke Koonce.

When Fitchthorn first heard about Herbalife and Bill Ackman, he wasn’t even interested in making a documentary.

“It seemed to be a story that was told one way to Wall Street and a totally different way to the people who were in the industry. And… it was just one of those stories that was harming people. But frankly, I like to say, robbing poor people is very profitable.”

(source)

To avoid a conflict of interest (and probably the SEC), Fichthorn covered his short position in Herbalife before the documentary started filming.

What is Betting on Zero About?

Betting on Zero chronicles the $1 billion bet Bill Ackman made in 2012 against Herbalife, a manufacturer of dietary supplements.

Ackman believed that Herbalife was a pyramid scheme disguised as a multi-level marketing venture and predicted that the share price of Herbalife, trading under ticker HLF, would eventually fall to zero. (source)

Interviews with John Fichthorn

If you want the full version, check out these interviews to hear John Fichthorn’s own words on Herbalife, multi-level marketing, and Betting on Zero.

- Wealth, Actually podcast: Hedge Fund Manager and Betting On Zero Producer, John Fichthorn where he says “We cover a lot in a short amount of time including what made the story interesting for John and how he and director, Ted Braun, were able to get the amazing access. Finally, we hear about the business (or lack thereof) of documentaries and some of John’s future plans.”

- CNBC video interview: John Fichthorn: Herbalife’s business is a scam – “The ‘FMHR’ traders and John Fichthorn, Dialectic Capital co-founder, discuss the money behind the movie “Betting on Zero” about Bill Ackman’s fight against Herbalife.”

Biltmore Films and Burke Koonce

John Fichthorn co-founded Biltmore Films with Burke Koonce, a securities analyst and former newspaper reporter. Here’s the mission of Biltmore Films:

“We bring business and financial stories to life. We draw upon our decades of experience in the world of finance to bring Wall Street to the screen with unadulterated and fascinating truthfulness.”

You can find out more about Biltmore Films or Burke Koonce on their respective pages:

Other Companies

Here are some other companies that John Fichthorn has worked with, or currently works with.

B. Riley Capital Management

In 2017, B. Riley Capital Management announced that it had acquired the rights to manage Dialectic Capital Management hedge funds. Fichthorn transitioned to B. Riley Capital Management as the Head of Alternative Investments.

Bryant Riley, the Chain and CEO of B. Riley Financial, said the following:

“Under John’s stewardship, Dialectic has established an impressive track record and reputation in the hedge fund industry. This acquisition is consistent with our strategy of expanding our capital management business, which now has nearly $1 billion in assets under management.” (source)

From their website, the services they offer include:

- Fund and Asset Management

- Specialty Direct Lending, via their sub-firm Great American Capital Partners – maybe this is a business development company

- Discretionary Fixed Income Investment Management

- Hedge Fund Services, where I’m guessing Fichthorn is primarily focused and potentially uses investor relations firms to relay news to their investors

Health Insurance Innovations and Benefytt Technologies

In 2015, Health Insurance Innovations, Inc. appointed Fichthorn to its board of directors and the company’s new Risk and Compliance Committee.

Fichthorn stated, “I am excited to join the HIIQ Board. In addition, that I have also been appointed to the Board’s newly-formed Risk and Compliance Committee demonstrates HIIQ’s commitment to even greater transparency and compliance.”

In March 2020, Health Insurance Innovations, Inc. (HIIQ) changed its name to Benefytt Technologies. They now trade under a new ticker BFYT.

TheMaven, Inc. aka Maven

In September of 2018, Maven appointed Fichthorn to the Board of Directors.

Maven is a pink sheets-traded publishing platform that claims to be “a media coalition of professional content destinations (‘mavens’)” and “a sustainable business platform for ‘mavens’ to operate, viewers to consume and major brand advertisers to market on a unified, pristine, high scale environment.”

Fichthorn, through B. Riley, partnered with Maven to help secure its investments after acquiring HubPages and Say Medi. (source)

A little over two months after joining the Board of Directors, Fichthorn became Chairman. (source)

That escalated quickly, right?

Quantum Corporation

In 2019, Quantum appointed Fichthorn to its board of directors. (source) This is exactly the type of company and shareholder stuff that I was interested in when I first started to research investor relations firms.

Quantum specializes in the storage and management of digital content. Some of Quantum’s clients include NASA, HBO, and GoPro. (source)

You can find out additional information here or on Quantum’s website.

Conclusion

This guy sounds interesting – and smart. I have a lot of respect for someone who funds investigative journalism like John Fichthorn did with Betting on Zero.

Making posts like this is a neat way for me to learn about someone. And maybe it’ll help you if you’re looking to do business with John Fichthorn.

Got a tip? Or am I missing anything from this page? Email or tweet me to say hello.

Bonus: The Betting on Zero Web Domain Battle

Herbalife and those associated with the Betting on Zero movie are still wrapped up in a prolonged Internet throwdown.

On one side, there’s bettingonzero.com, which is maintained by Herbalife to refute the information presented in Betting on Zero.

That’s not to be confused with bettingonzeromovie.com, the film’s official site. By clicking the header marked “ATTEMPTS TO SUPPRESS,” you can read the film’s response to the Herbalife attack site.